Amounts to a 5.9% Increase

As we projected in our November Voice, the Medicare Part B premium will be going up in 2024. This follows a drop in the premium during this year.

According to the CMS (Centers for Medicare and Medicaid Services), the standard monthly Part B premium will be $174.70 in 2024, an increase of $9.80 from $164.90 in 2023. This amounts to a 5.9% increase.

“While we don’t welcome premiums going up, it wasn’t totally unexpected,” comments Association President Valeri. “As we reported earlier, the Medicare trustees projected, back in March, a 2024 premium of $174.80.

“Remember this year’s reduced premium included the refund to Medicare beneficiaries for a portion of the 2022 premiums that had been set too high. Without that refund, this year’s standard premium would have been more than the $164.90 being paid now.

“We also anticipated that Part B spending would increase in 2024 with CMS’s recent approval of a new Alzheimer’s drug, Leqembi. While the drug will be used only with patients in the early stages of the disease, some estimate that its coverage will cost Medicare $2.7 billion annually.”

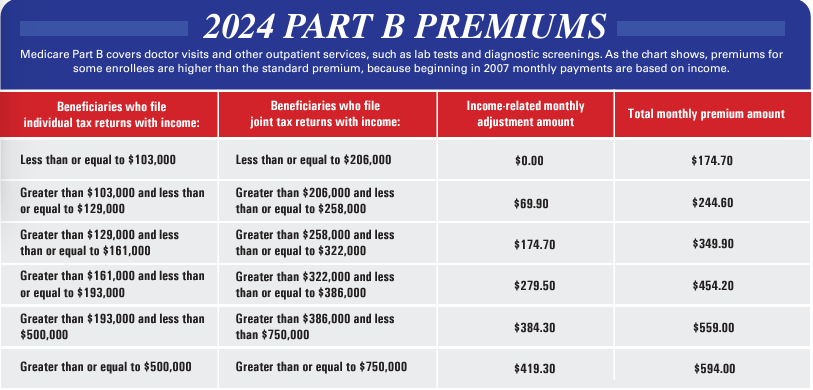

Here’s a table that shows the 2024 Part B standard premiums as well as the income-related monthly adjusted amounts or IRMMA.

What are these income-related monthly adjusted amounts that we’re showing here. And, who’s subject to them?

Since 2007, certain retirees, both from the public or private sector, pay higher Part B premiums based on their modified adjusted gross income. This is known as Medicare’s Income-Related Monthly Adjustment Amount or IRMAA.

An IRMAA monthly Part B premium includes an income-related adjustment for 2024 that will range from $244.60 to $594.00, depending on the extent to which an individual beneficiary’s modified adjusted gross income exceeds $103,000 (or $206,000 for a married couple). CMS estimates that about 8 percent of Medicare beneficiaries pay the income-adjusted premiums.

The Social Security Administration (SSA) determines who pays an IRMAA based on the income reported two years prior. So, the SSA looks at a retiree’s 2022 federal tax returns to see if they are subject to IRMAA in 2024.