No Increases In Copays & Deductibles

FEBRUARY 8, 2018: The state’s Group Insurance Commission has unanimously approved health insurance plan design for FY19, covering all six carriers and slightly lowering costs for some enrollees. Heeding calls from Mass Retirees and all public employee/teacher unions, copayments and deductibles will not increase for the coming year.

No Increases In Copays & Deductibles

FEBRUARY 8, 2018: The state’s Group Insurance Commission has unanimously approved health insurance plan design for FY19, covering all six carriers and slightly lowering costs for some enrollees. Heeding calls from Mass Retirees and all public employee/teacher unions, copayments and deductibles will not increase for the coming year.

Following a raucous three-weeks, where the GIC, in a close 8-5 vote, first approved a dramatic consolidation of health insurance plans, the Commission came together in agreement surrounding what is known as plan design. The term essentially refers to the range of benefits offered, how plans are structured and the cost of copayments and deductibles.

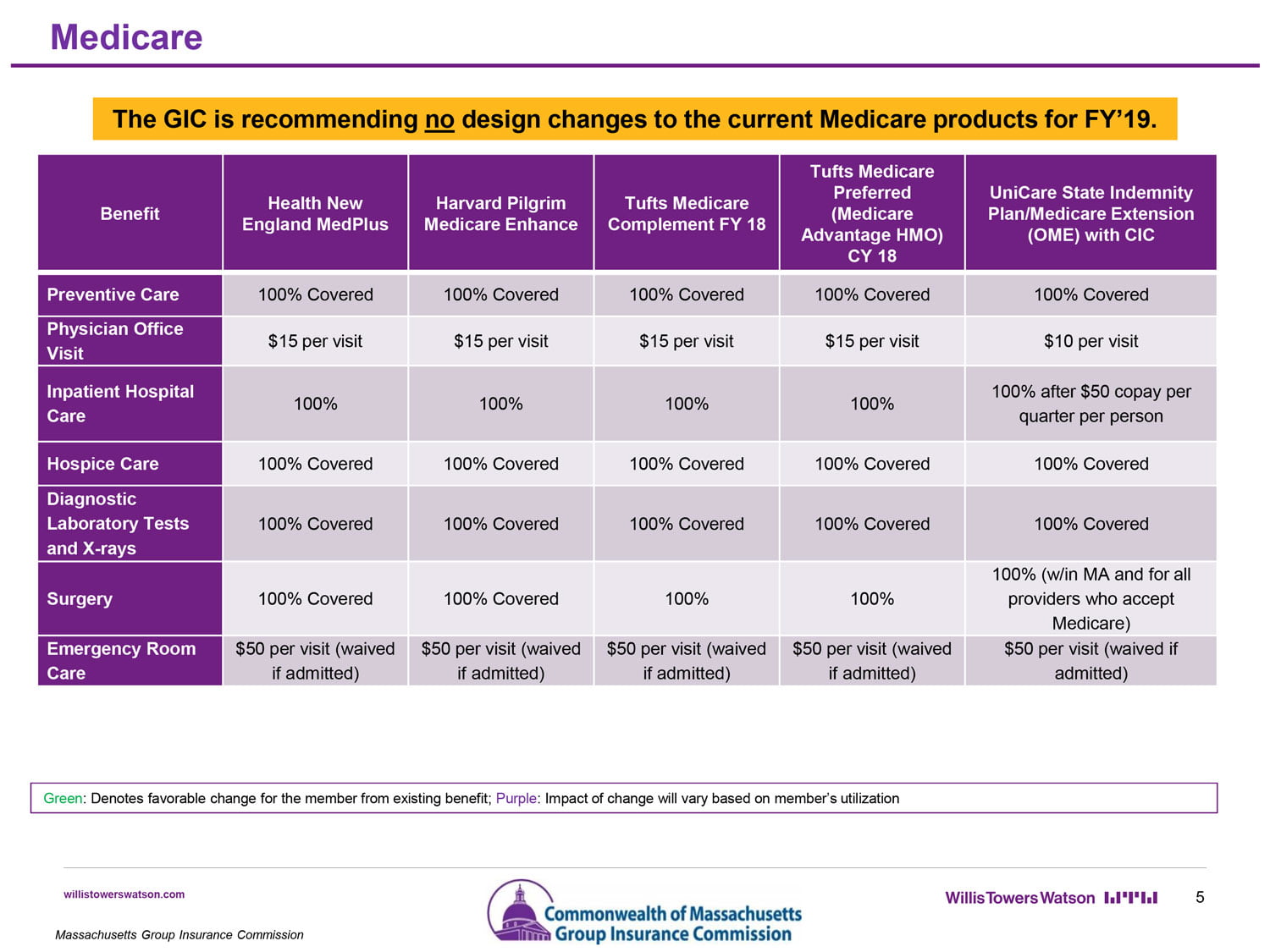

Copayments and deductibles paid by Medicare enrollees will not increase for FY19.

Among the out-of-pocket costs adjusted downward by the GIC is the Tier 3 Specialist copayment, which had been set at $90. Beginning July 1, that specific cost will be lowered to $75. Out-of-pocket maximums have also been standardized across all health plans at $5,000 per individual or $10,000 per family.

In recommending that the Commission reduce the Tier 3 Specialist copayment, Executive Director Dr. Roberta Herman explained that she had come to the realization that the copayment was too high after hearing complaints from enrollees.

“We appreciate the steps taken by the GIC to review out-of-pocket costs and make adjustments that benefit enrollees. Mass Retirees believes and continues to argue that overall costs are too high for many of our members. There are roughly 2,500 families with annual costs above $5,000. The financial burden is unbearable,” said Association Legislative Director Shawn Duhamel. “Thankfully the GIC opted not to increase copayments and deductibles for the coming year, but more needs to be done. Out-of-pocket caps should be lowered to a more reasonable level.”

In January, the GIC had voted to drop Fallon, Harvard Pilgrim and Tufts (non-Medicare) from the GIC’s health plan offerings. The move would have displaced and forced some 34,000 retirees and more than 100,000 active employees to switch health plans beginning July 1, 2018. The decision was made in an attempt to reduce healthcare costs and, according to the GIC, would have saved some $20.5 million in FY19.

Following an outcry of anger by retirees and active employees, the GIC reversed course and unanimously approved the continuation of all six current health insurance vendors for the coming three years.

In addition, UniCare will remain the insurer of choice for the more than 70,000 retirees enrolled in the Optional Medicare Extension (OME) Plan, as well as the carrier of the traditional GIC Indemnity Plan.