No Increase in Copayments or Deductibles

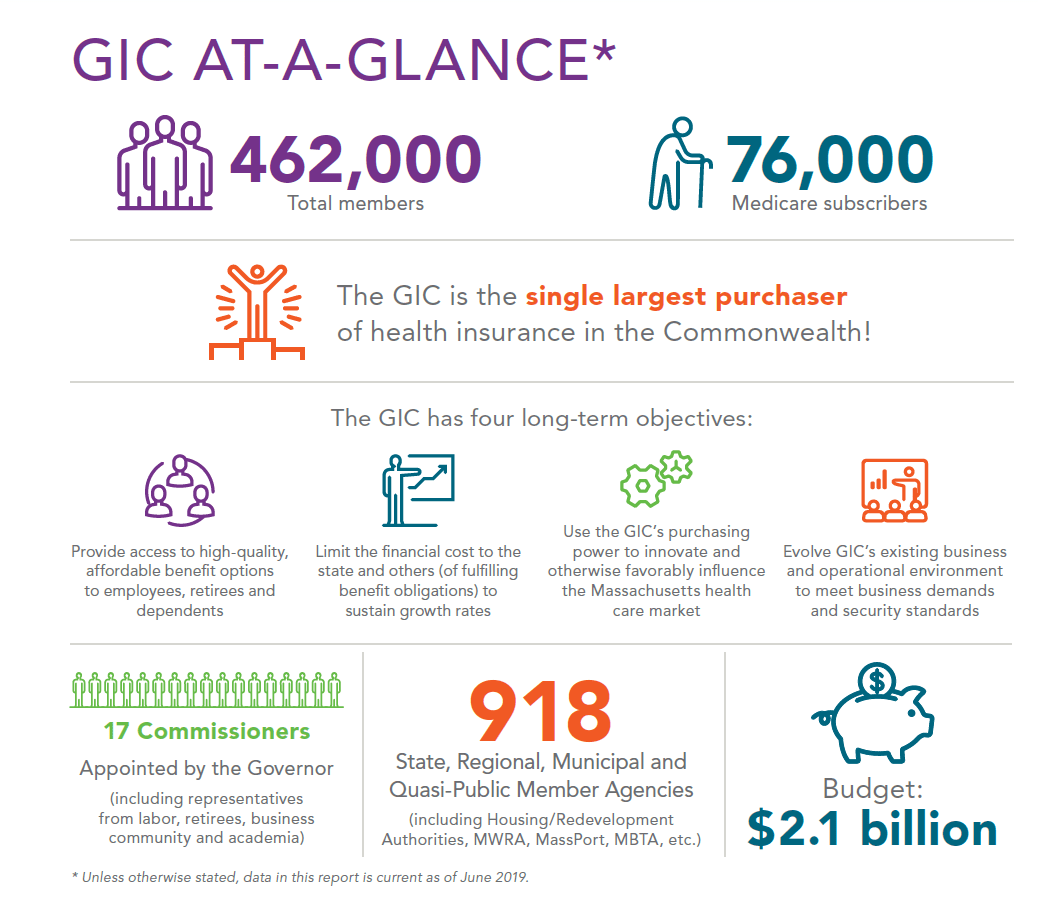

February 27, 2020: The 17-member Commission voted today on the rates for the health insurances plans to be offered by it. The new plan rates will be effective July 1. While members will see an increase in their monthly premiums, their copayments and deductibles will remain unchanged.

No Increase in Copayments or Deductibles

February 27, 2020: The 17-member Commission voted today on the rates for the health insurances plans to be offered by it. The new plan rates will be effective July 1. While members will see an increase in their monthly premiums, their copayments and deductibles will remain unchanged.

As anticipated by us in earlier reports, the average increase across all plans, non-Medicare and Medicare, is 5.1%. This increase is in-line with market trends between 5% and 7%. The GIC indicated that the driving factor is medical inflation, in other words, the cost of the product itself.

The cost of providing services such as labs and X-rays, ER visits, prescriptions and surgical procedures continues to rise even when utilization had decreased. The impact of this is reflected in the plan rate increases presented at today’s meeting.

For the GIC’s six Medicare supplement plans, insuring approximately 103,844 enrollees, the average premium increase is 3.2%. Approximately 75,000 of the total number are in the most popular plan, UniCare OME with CIC, followed by Harvard Medicare Advanced (over 16,000) and Tufts Medicare Complement plan (almost 9,500). The premium increase for all three of these plans is 3.3%.

It’s important to remember that the benefits across all Medicare plans remain the same as FY2020. The GIC will continue to offer the Tufts Medicare Preferred, the only Medicare Advantage option.

On the non-Medicare side, the average increase will be 5.5%, with the highest increase being 7.6% and the lowest 3%. The higher end increases are impacting the Tufts Health and UniCare plans that offer a broader network and products.

“While we may have anticipated rate increases, we’re particularly concerned by the higher increases for the non-Medicare plans and their impact on retirees who are not Medicare eligible,” comments Association CEO Shawn Duhamel. “This segment of retirees are already paying more in deductibles and copayments and these increases, in terms of real dollars, will only further undermine their fragile financial situation.

“No question, rising health care costs are unsustainable. That’s why we’ll continue to work with the GIC, insurers, providers and other interested parties, on addressing this core issue and hopefully providing needed relief to all retirees and their families.”