October 21, 2022: Thursday brought some highly anticipated news to the 460,000 enrollees covered by the state’s Group Insurance Commission (GIC). After months of closed-door work to review and score the winning bids from respondents through the procurement process, the GIC unveiled the 4 Medicare and 7 non-Medicare health insurance plans to be offered starting in FY24.

Before I outline the details of the plans selected, let me first remind you that Mass Retirees will hold a Tele-Town Hall meeting this afternoon (Friday) at 1:00 PM EST. The GIC’s health plan announcement will be one of several important items discussed.

We will also be joined at the start of the meeting by a special guest speaker – our endorsed candidate for Lt. Governor – Salem Mayor Kim Driscoll.

To participate in today’s meeting, simply accept the incoming auto-connection call at 1PM or call toll free 833-491-0336 during the time of the meeting.

Now for the details on the big news that we’ve been anticipating for many months. In doing so, let me again point out that news generated by the GIC is not only important to retirees and employees covered by the state insurance plans. Policy decisions made by the GIC are closely watched by local officials, who can very quickly replicate those policies at the local level with limited input from local retirees and active employee unions.

That is why we place so much importance on decisions made by the GIC. Those decisions can and do have a major impact on all public retirees and active employees.

Before explaining the details unveiled yesterday by the GIC, let me first make clear that we do not yet know any details concerning premiums, copayments, deductibles, or plan design. All of those items will be decided at the January, February and March Commission meetings.

What we do know is that Thursday’s announcement of health plan selection contained good news. Medicare eligible retirees will have access to the same three Medicare supplement plans and one local Medicare Advantage plan currently offered by the GIC. The Medicare Supplement plans are Health New England, Harvard Pilgrim Health Care, and UniCare. Tufts Health Plan will continue to offer the locally networked Medicare Advantage Plan.

While both Aetna and United Healthcare submitted proposals to create a national Medicare Advantage Plan, GIC officials opted not to pursue the option at this time. It appears that the GIC had concerns that such a move might prove to be overly disruptive to retirees – a sentiment that we certainly appreciate! However, the door remains open for the inclusion of such a national plan in the future.

Given that the vast majority of Medicare eligible retirees are enrolled under UniCare’s Optional Medicare Extension (OME) Plan, the announcement that UniCare will be retained is welcome news. As the former John Hancock plan, UniCare has been a key GIC vendor for more than 40 years.

On the non-Medicare side, there are some interesting changes to announce. First, once again the four companies providing the seven different non-Medicare health insurance plans are all based here in Massachusetts. All four are also current GIC vendors.

The non-Medicare carriers include Allways, Harvard Pilgrim Health Care, Health New England, and UniCare. Allways, which is owned by the hospital network Mass General Brigham, will be rebranded for FY23 as Mass General Brigham Health Plan. Harvard Pilgrim Health Care and Tufts Health Plan are specific insurance plans offered by Point 32.

For non-Medicare eligible retirees living outside of New England, one key change is important to note. Starting July 1, 2023 Harvard Pilgrim Health Care will become the GIC’s National plan – replacing the UniCare Basic Plan. UniCare’s non-Medicare membership will be restricted to those retirees and active employees living in New England and overseas.

The GIC states that the reason for the change in the National Plan is that HPHP offers a “greater value and premium savings for the GIC and its members.” The GIC reports that some 4,200 members are enrolled in the Basic Plan outside of New England today. Many of these members are non-Medicare retirees living year-round in states like Florida.

During the lead up to the procurement process, the GIC received specific feedback from retirees living outside of New England who asked for a more affordable health insurance alternative. As a National Plan, HPHC will utilize the network offered by United Healthcare. According to the GIC, 97-98% of claims submitted in FY22 are in-network under HPFC.

As members might know, our Association continues to advocate for the transition of non-Medicare eligible retirees (age 65 and over) into Medicare through what is known as the Medicare buy-in program. At present the GIC enrolls some 10,000 non-Medicare eligible retirees within the same health plans used by active employees.

Experience in dozens of municipalities has proven the Medicare buy-in program to be beneficial to both the employer and retirees. Due to the procurement process, the GIC was unable to pursue implementing the program for FY24. However, once procurement is completed this winter, our Association will advocate that GIC implement the Medicare buy-in program at the state level. If we are successful, the program would take effect for FY25 (7/1/24).

The next major step in the GIC’s procurement process will be the announcement in December of the Medicare and non-Medicare pharmacy benefits. This will be followed in January by the finalization of plan design (copayments and deductibles) and then the finalization of insurance premiums in February and early March.

GIC officials will also join our Association for a special Tele-Town Hall meeting in late January, where details of FY24 plan offerings will be discussed in detail. Most important, this event will also present the opportunity for Mass Retirees members to ask questions directly of GIC leaders.

While a lot of work remains to be done and many details are still unknown, this week’s announcement is very good news for retirees. It is also encouraging that GIC officials listened to the feedback they received from retirees heading into the procurement process and took positive steps toward affordability, while maintaining high-quality offerings.

If you have questions about what I’ve reported this week, please join us for today’s Tele-Town Hall meeting. If you can’t make it, but have a question or concern, please feel free to contact me or our Insurance Coordinator Cheryl Stillman directly. Just remember, currently we do not have any information regarding plan design or costs. Those decisions have not yet been made by the GIC.

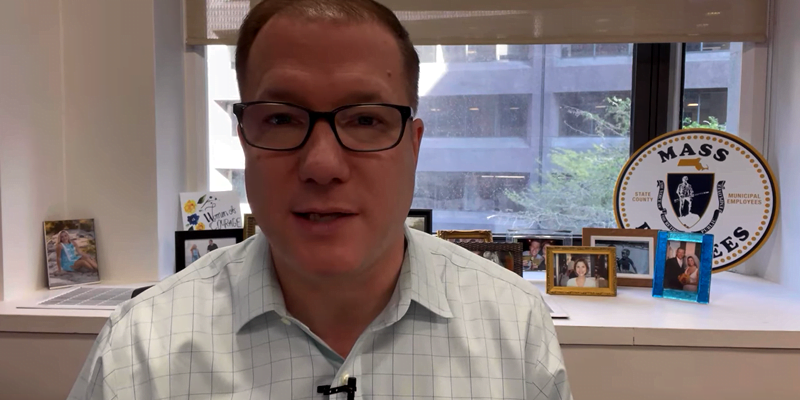

Watch the video report by clicking here to play.

With great appreciation,

Shawn

Shawn Duhamel

Chief Executive Officer

Mass Retirees Association