Includes Major Provisions Benefiting Retirees

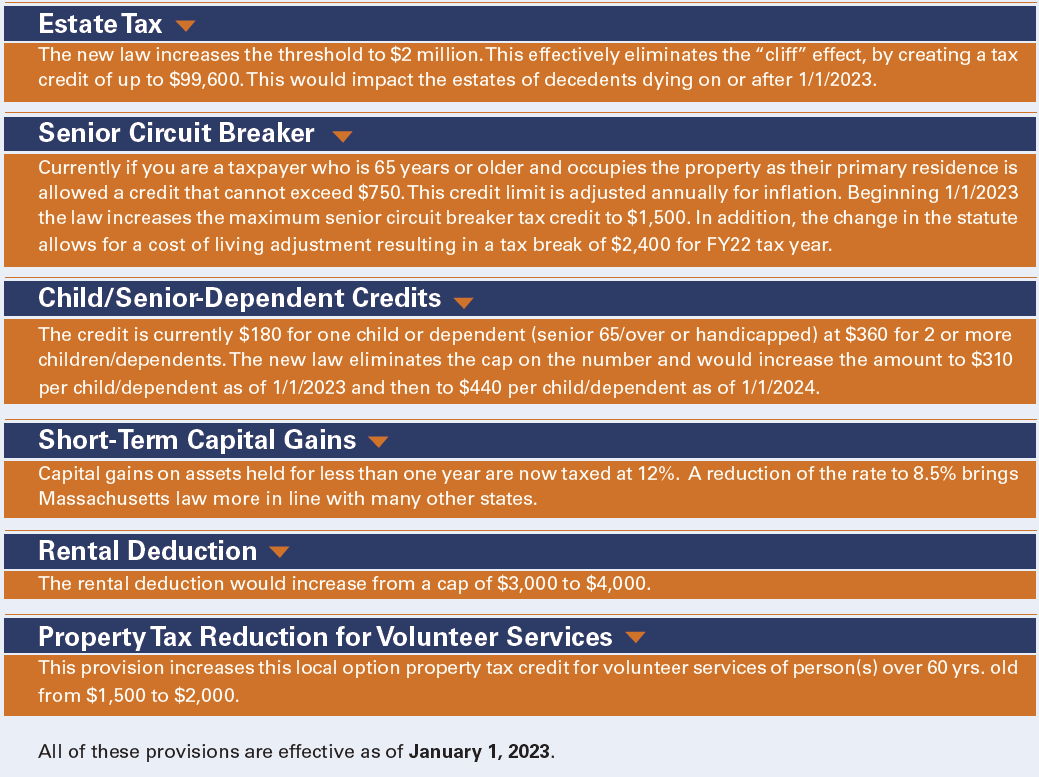

While the legislation awaits the governor’s signature at press time, there’s no question that tax relief will become law, providing about $561 million in relief in the current fiscal year (FY24) and more than $1 billion by FY27. Within the new comprehensive law, there are major provisions that directly benefit retirees and their families.

Since our May issue, we’ve been monitoring the progress of the legislation. Our focus has been on its proposals to reform three major parts of the state’s tax law – the estate tax, property tax relief (circuit breaker) and the income tax, specifically a credit for families with dependents 65 or over.

When we last reported on this in our July Voice, the legislation was pending in the Senate. Since then, the Senate enacted its version of tax relief, including the three proposals outlined above.

To iron out the House and Senate differences, a House-Senate conference committee was convened, led by the chairmen of the House and Senate Ways & Means, Rep. Aaron Michlewitz and Sen. Michael Rodriguez respectively. On September 26, the conference committee issued its compromise legislation that was passed by both the House and Senate and then sent to the governor for her signature.

“We’re pleased to report that all three reforms are in the legislation on the governor’s desk,” according to Legislative Chairman Tom Bonarrigo. “House Speaker Ron Mariano, Senate President Karen Spilka, as well as the Ways & Means chairmen and the Revenue Chairs, Rep. Mark Cusack (D-Braintree and Sen. Susan Moran (D-Falmouth), should be recognized for their leadership on this issue.

“These and other reforms will help retirees and their families.