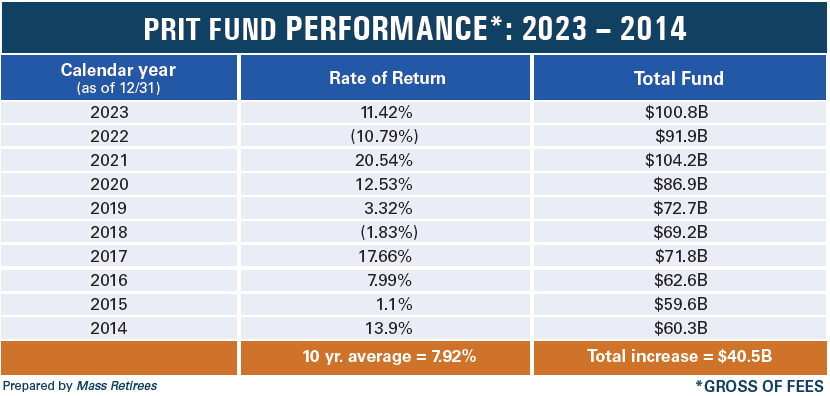

Positive news on 2023 investment returns has been reported from the Commonwealth’s pension fund, PRIT (Pension Reserves Investment Trust) Fund, that contains the pension funds for both the State and Teachers’ Retirement Systems. According to the PRIM (Pension Reserves Investment Management) Board that manages and invests PRIT, as well as all or a portion of the investment funds for 97 of the 102 local retirement boards (95% of the total), the Fund realized a very strong performance on its investments last year, achieving a robust return of 11.4% gross (11.2% net of expenses).

Association President Frank Valeri responded to the news as follows. “This is a very welcome rebound from the double-digit downturn in the prior (2022) year. As we entered 2023, there appeared to be some favorable signs, but with the focus on a potential recession, no one predicted the strong performance that we experienced throughout the year. Our Association applauds the PRIM Board, chaired by State Treasurer Deb Goldberg, its Executive Director/Chief Investment Officer Michael Trotsky and staff for all their hard work in achieving this result.”

Also, it’s significant that with last year’s net asset gain of $10 billion, PRIT has crossed the important milestone of $100 billion plus in total assets. “As our Chart here shows, PRIT’s value has grown by an amazing 67% over the past ten years – basically from $60 billion to $101 billion,” continues Valeri. “Just this past year, the $10 billion asset gain represents excess earnings of more than $2.5 billion over the assumed 7% rate of investment return.”

“PRIM Board’s diversified, long-term investment strategy has enabled the PRIT Fund to perform well in a variety of market conditions,” adds Association Executive Vice President Paul Shanley, who has served as an elected Board member and on its Investment Committee since 2008. “No question, our commitment to achieve successful investment returns will continue now into the future.”

Valeri concludes, “When it comes to improving the Cost-of- Living Adjustment (COLA), Mass Retirees has always believed that the investment success of retirement systems should be shared with their retirees and survivors with better COLAs. Since July 2022, our core belief has been adopted by 98% of the 102 local retirement systems that have increased their COLA with two exceptions, Amesbury and Fall River. Thank you and we’ll be there with you to do even more.

“PRIT’s success also will be of tremendous help in Mass Retirees’ ongoing campaign to improve the State & Teacher COLA. Our work on this is unwavering, and we remain confident, will produce positive results.”