Key Factors Impacting a Cola Base Increase

Earlier we highlighted the success that retirement boards achieved investing their pension funds in 2023. Again, we’re able to do this using the comprehensive 2023 Investment Report by PERAC (Public Employee Retirement Administration Commission).

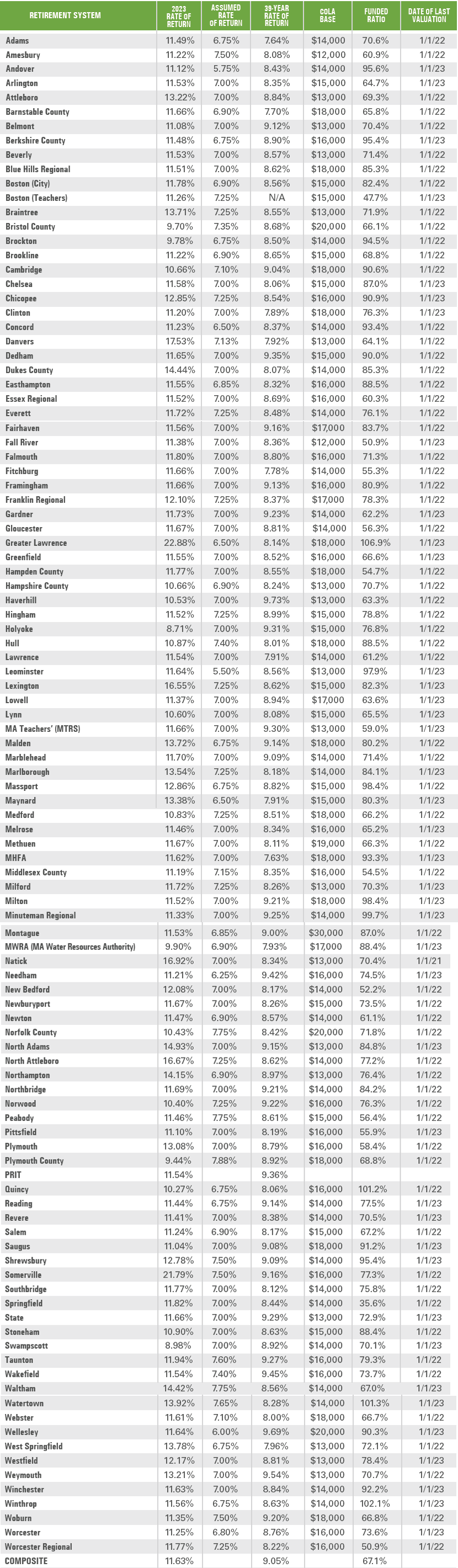

The Tables below provide details from the Report, as well as other key factors not in the Report (for example, Assumed Rate of Return and COLA Base) that impact a decision by retirement systems to increase their COLA Base, thereby raising the maximum COLA amount for retirees and survivors.

Please note that the column, entitled 39-Year Rate of Return, shows the rate of return for a period of 39 years that refers back to the 1983 enactment of Chapter 661, the omnibus reform law relating to pension funding and investing. In addition to establishing the state’s PRIT (Pension Reserves Investment Trust) Fund and PRIM (Pension Reserves Investment Management) Board,

Chapter 661 included creating “6A Pension Reserve Funds” for retirement systems to meet future pension liabilities. Four years later (1987), the legislature enacted another comprehensive pension reform, Chapter 697, that allowed retirement systems to adopt and implement new Section 22D pension funding schedules that they maintain today.

In establishing a funding schedule, a retirement system makes certain actuarial assumptions including the Assumed Rate of Return from its investments. As the Tables show, the 2023 Return exceeded the Assumed Rate of Return for all 104 retirement systems.

If the actual return rate exceeds the assumed rate, then the system will have a higher funded ratio which is the ratio of a plan’s assets to its liabilities.

Finally, we should point out that the funded ratios published in the next to last column do not contain the 2023 rate of investment returns. Members should look to the valuation date of each system when reviewing its funded ratio.