As Prit Fund on Track for 2nd Consecutive Double-digit Return

Through the first three quarters of 2024, the Commonwealth’s $110.5 billion Pension Reserves Investment Trust (PRIT) Fund earned 10.01%, gross of fees.

The PRIT Fund, which contains the pension assets of both the State and Teachers’ Retirement Systems, as well as assets from roughly 2/3rds of the 102 local retirement systems, is now on pace to deliver another banner – perhaps double digit – investment year. Should the fund end 2024 on its current pace, returns in three of the past four years will have significantly beaten investment assumptions.

While the Commonwealth assumes a conservative average annualized investment return of 7%, through September 2024 PRIT’s 5-year return is 9.17%, 10-year 8.33%, and 38-year return (since inception) 9.36%. Since 2012, the state has gradually lowered its assumed rate of return from 8.25% to the current 7% – where it has remained since 2021.

Beating the assumed rate of return over a sustained period not only means that the system is doing financially well, but it also reduces the system’s unfunded liability ahead of schedule and can help pay for improved COLA benefits for retirees. As we have routinely stated, we firmly believe that the success of our public pension systems must be shared with retirees through improved COLA benefits.

Beating the assumed rate of return over a sustained period not only means that the system is doing financially well, but it also reduces the system’s unfunded liability ahead of schedule and can help pay for improved COLA benefits for retirees. As we have routinely stated, we firmly believe that the success of our public pension systems must be shared with retirees through improved COLA benefits.

The PRIT Fund is managed by the Pension Reserves Investment Management (PRIM) Board, on which Association Executive Vice President Paul Shanley serves as an elected member. PRIM, which is comprised of nine members, is chaired by State Treasurer Deb Goldberg and led by Executive Director and Chief Investment Officer Michael Trotsky.

This is where a second piece of good news comes into play. This fall, the Public Employee Retirement Administration Commission (PERAC) published the 2024 Actuarial Valuation Reports for both the State and Teachers’ Retirement Systems. PERAC is the state’s pension oversight and regulatory agency and is led by Executive Director Bill Keefe. John Boorack is PERAC’s Chief Actuary.

By state law, both the State and Teachers’ Retirement Systems must undergo an annual valuation, with the systems’ funding schedules set every three years. Valuations for the 102 local retirement systems are conducted every other year by either PERAC or one of several private actuaries serving the Massachusetts public pension community, with local funding schedules reset every two years.

Whether the valuation is conducted by PERAC or a private actuary, a similar format is followed that is based on industry best practices and actuarial standards. And while the details below focus specifically on the State and Teacher Retirement Systems, the positive results are largely reflected across the remaining 102 systems.

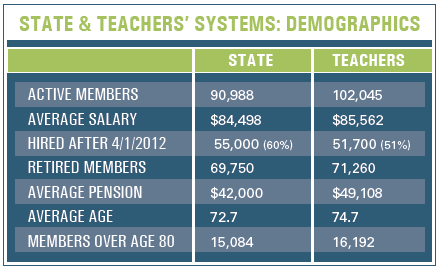

Among the central findings of the 2024 State Retirement System Actuarial Valuation Report is the fact that the system is now 72.5% funded, up 1.7% from just a year ago. The system now has total assets of $37 billion, with an unfunded liability of $14 billion.

The Teachers’ Retirement System, which is also funded and administered by the state government, is now 60.4% funded, an increase of 1.2% from a year ago. The MTRS has $39 billion in assets and some $25.5 billion in unfunded liabilities remaining.

A system’s unfunded liability is the shortfall that would exist in paying accrued retirement benefits owed to current retirees and vested employees. In addition to paying off the accrued unfunded liability, the government also pays its share of what is known as “normal cost”, which is the ongoing accrual of benefits owed to future retirees.

Both the State and Teachers’ Retirement Systems are scheduled to be fully funded by FY 2036, less than 11 years from now. Proper retirement funding did not begin in Massachusetts until 1986. Since that time, the Commonwealth and most municipal governments have worked to pay off the employer’s share of unfunded liabilities that have amassed over the decades.

It should also be pointed out that municipal governments do not pay for the cost of teachers’ pensions. Those costs, like those for state employees/retirees, are entirely born by the state as has been the case for at least a century.

The Commonwealth’s current triannual pension funding appropriation is $4,104,583,378 in fiscal year 2024; (ii) $4,499,854,757 in fiscal year 2025; and (iii) $4,933,190,770 in fiscal year 2026. The funding schedule and new appropriation amounts are scheduled to reset for FY27, which begins on July 1, 2026. The “normal cost” paid by the state related to the State Retirement System in 2024 was $463.2 million.

Normal cost for the Teachers retirement system, which is also paid for by the state, was $454.4 million. It should be noted that the combined $917.6 million in normal costs paid by the state is less than the more than $1 billion in Social Security contributions that would be required if Massachusetts public employees participated in Social Security and the Commonwealth paid the 6.2% payroll tax to the federal government.

The combination of annual budget appropriations, employee contributions, and strong investment gains – along with sound financial management, have resulted in all 104 of the state’s public retirement systems being well on track to achieve full funding at or before the statutory deadline of 2040.

“A critical point made within PERAC’s valuation reports for both the State and Teachers’ systems is the fact that asset gains have significantly outpaced total liabilities since 1990. As stated in the reports, this is a sign of a healthy retirement system,” notes Mass Retirees President Frank Valeri, who is also an elected member of the State Retirement Board and our Association’s designee serving on the Special COLA Commission.

“Our retirement systems are very well managed, and PRIM continues to do an outstanding job investing and growing pension system assets, which belong to retirees and employees. Now is the time to start planning for what comes next, now that our systems are nearing fully funded status. This success must be shared with the beneficiaries. Retirees have gone without for too long. That has to change.”