Standard Part B Increasing By 9.7%

Symptomatic of today’s ever increasing healthcare costs, most Medicare beneficiaries will experience a 9.7% increase in their standard Part B premium from $185 to $202.90, beginning January 1. While this nearly double-digit increase is less that the projections by the Medicare Trustees (see October Voice), it’s still the second- largest increase in the program’s history behind 2022’s $21.60 increase and is almost 3.5 times the recently announced 2.8% Social Security raise for 2026.

Association President Frank Valeri reacted to the news: “Yes, it’s not unexpected and may be less than earlier projections, but any premium increase, in this case by almost 10%, is not welcome news for Medicare beneficiaries, including myself, who will also see their Social Security go up by a much smaller percentage next year.”

In announcing the increase, the Centers for Medicare and Medicaid Services (CMS) stated that the premium increase “is mainly due to projected price changes and assumed utilization increases that are consistent with historical experience.” Simply put, the CMS forecast reenforces what we pointed out at the very beginning, namely that healthcare costs will continue to rise in 2026.

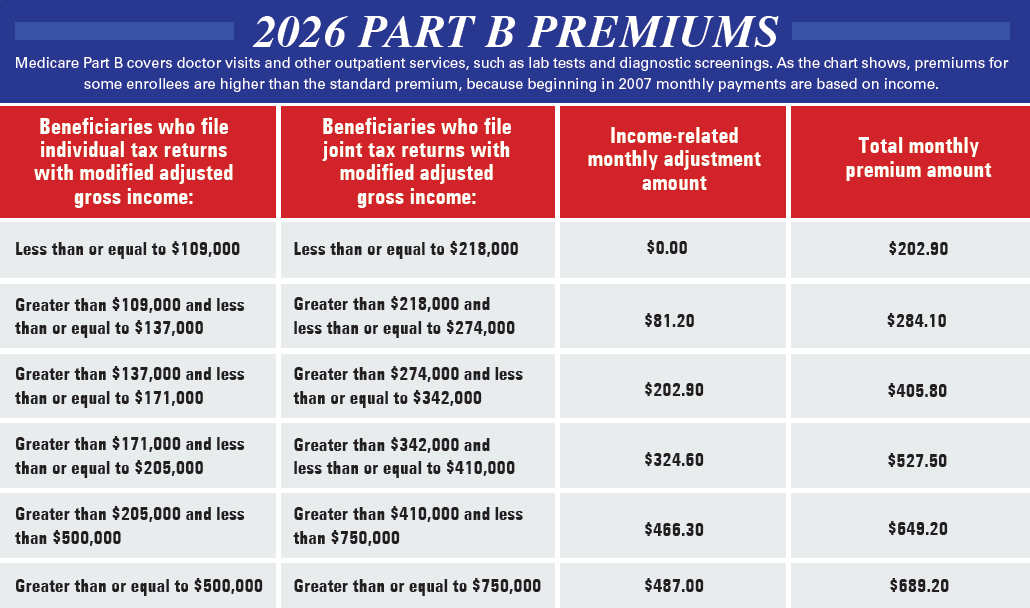

Higher IRMAA Rates

While most Medicare retirees will be paying the standard premium, roughly 8% with higher incomes (over $109,000 for an individual and $218,000 for a married couple) are subject to IRMAA (Income-Related Monthly Adjustment Amount). Since 2007, higher-income Medicare retirees, both from the public and private sectors, have been paying an additional amount on top of the standard premium. As shown in the Table below, the additional amount, ranging from $81.20 to $487.00, is dependent upon the modified adjusted gross income reported by a retiree on their federal return filed two years prior. For 2026, the Social Security Administration (SSA) will be focusing on a retiree’s 2024 federal income tax return to determine if they are subject to IRMAA.