Many Retirees Will See Lower Premiums

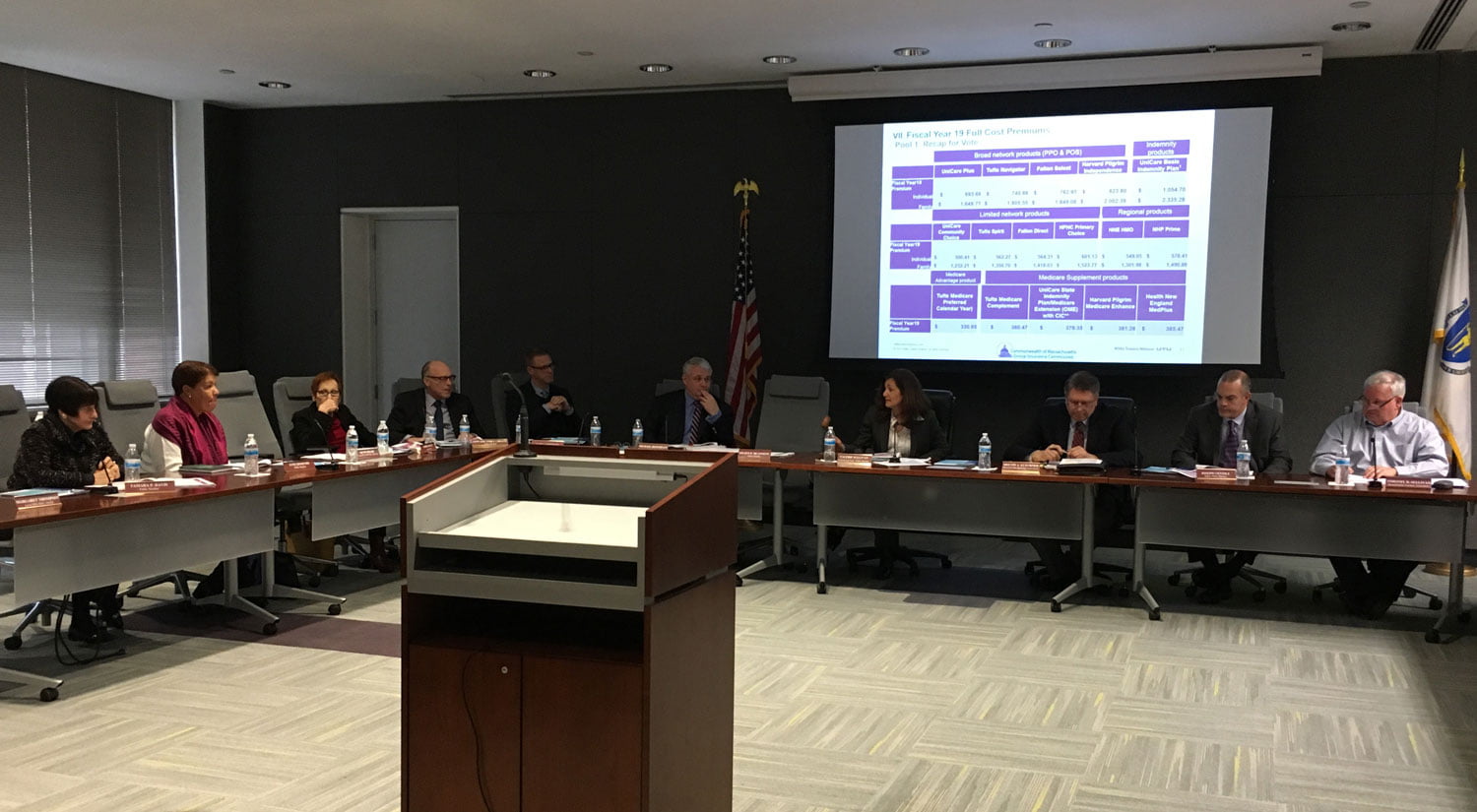

February 22, 2018: Today, the state’s Group Insurance Commission (GIC) approved health plan premiums for FY19. For the first time in recent memory, the average increase across all six GIC health plans is zero percent.

Beginning in June, the majority of retirees enrolled in GIC health plans will see a slight decrease in their monthly insurance premiums. For both retirees and active employees, the inflationary and premium rates vary by health plan.

Many Retirees Will See Lower Premiums

February 22, 2018: Today, the state’s Group Insurance Commission (GIC) approved health plan premiums for FY19. For the first time in recent memory, the average increase across all six GIC health plans is zero percent.

Beginning in June, the majority of retirees enrolled in GIC health plans will see a slight decrease in their monthly insurance premiums. For both retirees and active employees, the inflationary and premium rates vary by health plan.

Medicare enrollees, insured under the UniCare Optional Medicare Extension (OME) plan, will see their monthly premiums drop by .3%. Some 65,000 retirees and their dependents are enrolled in the OME plan, which provides nation-wide coverage.

Meanwhile, Medicare retirees enrolled in Harvard Pilgrim’s Enhanced plan will see a 9.6% reduction, with Tufts Complement -5.4% and Health New England coming in at -2%. While Tufts Medicare Preferred registers a 10.3% increase in cost, it remains the GIC’s lowest cost Medicare plan.

On the non-Medicare side (retirees and active employees), UniCare Basic Indemnity rates increase by 1.9% for individual coverage and decreases 3.6% for families.

Non-Medicare Broad Network Plans

| Plan | Individual | Family |

| Fallon Select | 3.9% | 4.9% |

| HP Independence | 0.3% | -0.1% |

| Tufts Navigator | 2.0% | 1.9% |

| UniCare Basic Indemnity | 1.9% | -3.6% |

| UniCare Plus | 0.4% | -0.1 |

Non-Medicare Limited Network Plans

| Plan | Individual | Family |

| UniCare Community Choice | -3.5% | -1.0% |

| Tufts Spirit | 2.0% | 1.8% |

| Fallon Direct | 2.1% | 6.9% |

| HPHC Primary Choice | -2.8% | 1.0% |

| HNE HMO | 0.5% | -3.9% |

| NHP Prime | 1.9% | 4.8% |

The 17-member GIC heeded calls from Mass Retirees and union leaders not to increase copayments and deductibles for FY19. Today’s vote reaffirmed the decision two weeks ago not to increase out-of-pocket costs for the coming year.

Individual monthly costs are determined by the percentage in which a retiree contributes. State retiree percentages are at three levels of contribution, dependent upon the date of retirement (10%, 15% and 20%). Active state employees are at two rates, 20% or 25%, dependent upon the date of higher.

Municipal rates are set by each city or town and vary from 10% to 50%, with the municipal average now approximately 75/25.

While today’s news is welcomed, GIC Executive Director Dr. Roberta Herman made it clear that no one should expect lower costs to be the trend in FY20 or future years to come. The driving factors behind this year’s rate stabilization was largely the new pharmaceutical contracts with CVS and Express Scripts, which will save at least $91 million in FY19.

“Dr. Herman was kind enough to call our office less than an hour after today’s meeting. She wanted to make sure we are comfortable with the recent decisions, answer any lingering questions and offered to work closely with Mass Retirees in the coming months to better prepare for what will come next year,” said Legislative Director Shawn Duhamel, who, along with General Counsel Bill Rehrey, was present at today’s meeting. “We believe we have a positive outcome for FY19 and appreciate the steps taken by the GIC to address our concerns. It is important that we work with labor and the GIC to find new ways to control healthcare costs that do not cost shift or undermine the quality of benefits.”

The GIC will mail detailed benefit decision guides to all enrolled retirees and employees in March.