Mass. municipalities & school districts hit hard by rising health insurance costs

January 5, 2026From the MediaBy James Vaznis, Globe Staff Escalating health insurance costs turned into a budget nightmare this academic year for Pioneer Valley ...Read More - Mass. municipalities & school districts hit hard by rising health insurance costs

Revenue outlook muted, still growing as fiscal 2027 budget begins

December 16, 2025From the Media, Breaking NewsEstimates show surtax, capital gains declining amid volatility By Katie Castellani, State House News Service STATE HOUSE, BOSTON, DEC. 16 ...Read More - Revenue outlook muted, still growing as fiscal 2027 budget begins

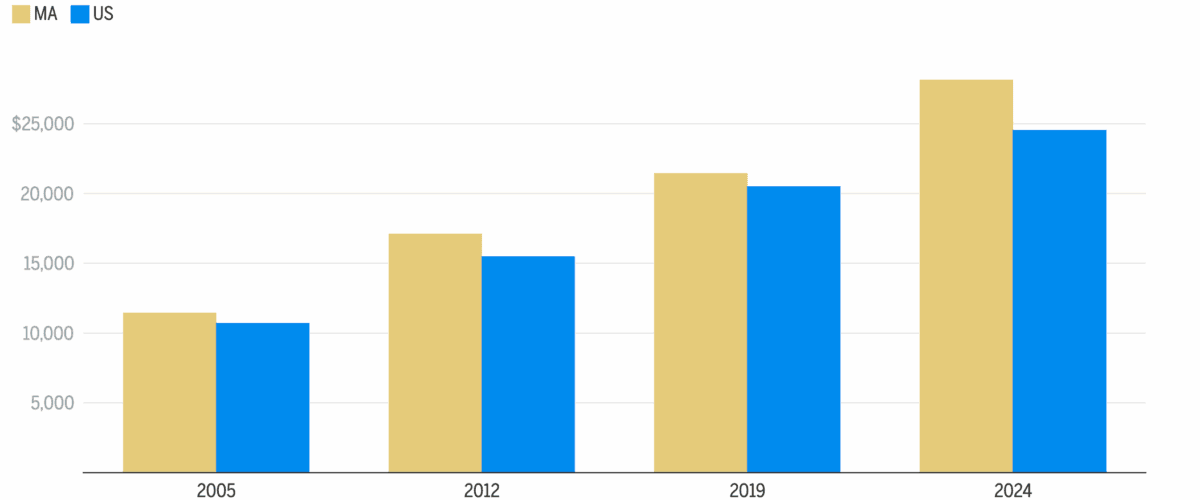

‘We’re at a breaking point’: Health insurance premiums just keep going up, worsening affordability crisis

November 28, 2025From the MediaBy Jessica Bartlett and Marin Wolf Globe Staff Each time one of Tamara Modig’s children needs a telehealth appointment ...Read More - ‘We’re at a breaking point’: Health insurance premiums just keep going up, worsening affordability crisis

Outlook For The Next Six Weeks

November 7, 2025Weekly News UpdateThis week, we have a short update regarding our focus over the next six weeks leading up to the holiday ...Read More - Outlook For The Next Six Weeks

Turning 65 and Medicare Enrollment

October 13, 2025Breaking NewsWith Medicare’s annual Open Enrollment period about to begin on October 15, this is a good opportunity to revisit ...Read More - Turning 65 and Medicare Enrollment

Retiree Health Insurance Developments

October 3, 2025Breaking NewsWeekly Update, October 3, 2025: This week our focus returns to retiree healthcare, both at the state and municipal levels ...Read More - Retiree Health Insurance Developments

Mass Retirees Legislative Update: Association Bills Receiving Public Hearings

September 9, 2025NewsSince the July edition of The Voice, the public hearing process has picked up pace. According Nancy McGovern, Director of ...Read More - Mass Retirees Legislative Update: Association Bills Receiving Public Hearings

COLA Commission Work Continues: Focus on Creating Enhanced Benefit

September 9, 2025NewsWhile local retirement systems continue to focus on incrementally increasing their respective COLA base, the work of the state’s ...Read More - COLA Commission Work Continues: Focus on Creating Enhanced Benefit

Locals Continuing to Increase Their COLA Base: Nineteen Systems Increase Fy26 Base

September 9, 2025NewsOver the past 5 fiscal years (FY22- FY26) Mass Retirees is pleased to report that local retirement systems have continued ...Read More - Locals Continuing to Increase Their COLA Base: Nineteen Systems Increase Fy26 Base