Articles about Legislation that may be useful to Massachusetts retirees.

Outlook For The Next Six Weeks

November 7, 2025Weekly News UpdateThis week, we have a short update regarding our focus over the next six weeks leading up to the holiday ...Read More

Mass Retirees Legislative Update: Association Bills Receiving Public Hearings

September 9, 2025NewsSince the July edition of The Voice, the public hearing process has picked up pace. According Nancy McGovern, Director of ...Read More

2025 – 2026 Legislative & Budget Update

June 19, 2025NewsThe legislative session is in full swing with activity on the Fiscal Year 2026 budget underway between the middle of ...Read More

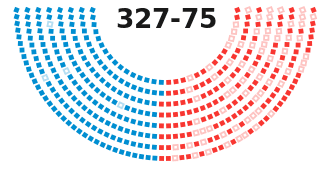

MASS RETIREES 2025-2026 Legislative Program

May 13, 2025NewsThe new legislative session commenced on January 1 with the swearing-in of the 194th General Court. Representative Ronald Mariano ...Read More

Fy26 Budget Update

April 14, 2025NewsThe Governor initiated the fiscal year 2026 budget cycle by presenting the Administration’s version of the budget at the ...Read More

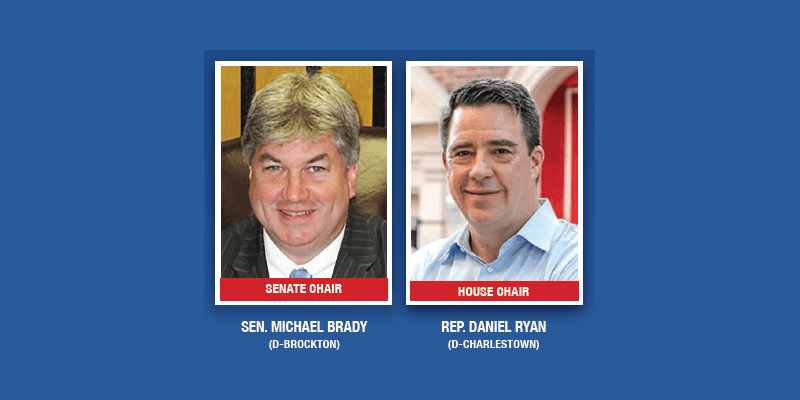

Public Service Committee Begins Work

April 12, 2025NewsIn late February, the House and Senate announced legislative committee assignments for the 2025-2026 legislative session. The Joint Committee ...Read More

Mass Retirees 2025-26 Legislative Proposals

January 30, 2025Breaking NewsMass Retirees has filed our 2025-2026 Legislative package. The proposal contains 18 bills – 12 filed in the House and ...Read More

Mass Retirees Legislative Update

December 16, 2024News2025-2026 Legislative Session Beginning With Association Filing New Proposals The 2025-2026 legislative session will get underway on New ...Read More