Articles about Retirement Boards that may be useful to Massachusetts retirees.

State Retirement Board Improves Operations

September 9, 2025NewsEstimated Benefit Payment Plan Plays Significant Role A recently issued follow- up Audit by the Commonwealth’s pension oversight agency ...Read More - State Retirement Board Improves Operations

Retirement Boards Elections & Appointments

September 9, 2025NewsBelmont – Ross Vona, a firefighter, was unopposed and was reelected to the Belmont Retirement Board. Ross is beginning his fourth ...Read More - Retirement Boards Elections & Appointments

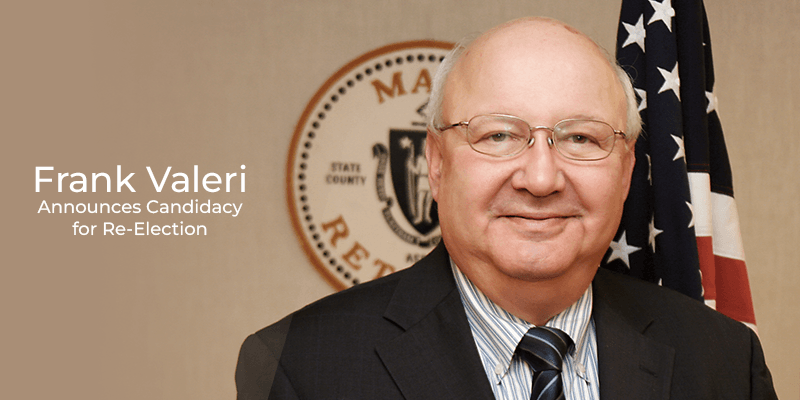

Valeri Announces Reelection for the State Retirement Board

September 8, 2025News, Breaking NewsMass Retirees President Frank Valeri has announced he will be a candidate for reelection to the State Retirement Board. Since ...Read More - Valeri Announces Reelection for the State Retirement Board

Retirement Boards: Elections & Appointments

June 19, 2025NewsBoston – The Boston Retirement Board held a special election to replace Firefighter Michael O’Reilly who had resigned as one ...Read More - Retirement Boards: Elections & Appointments

Retirement Boards: Elections & Appointments

May 13, 2025NewsBrockton – The Brockton Retirement Board reappointed retired Plymouth Retirement Board Executive Director Bill Farmer* as their 5th member. Bill was ...Read More - Retirement Boards: Elections & Appointments

UPDATE: State Board Estimated First Pension Payment

April 6, 2025NewsEIBP “Paying Off” During Initial Operation As one of the two elected members of the Mass State Retirement Board (MSRB ...Read More - UPDATE: State Board Estimated First Pension Payment

Major Change at Executive Director Teachers Board

December 16, 2024NewsWith the new year, there will be major changes in the leadership at the Mass Teachers Retirement System (MTRS). Its ...Read More - Major Change at Executive Director Teachers Board

Retirement Boards Elections & Appointments

December 16, 2024NewsAdams – Newly appointed Town Accountant/Finance Director Ashley Satko will also serve as the new 5th member of the Adams ...Read More - Retirement Boards Elections & Appointments