Articles about Social Security that may be useful to Massachusetts retirees

QUICK OVERVIEW: Your 2025 Social Security & Federal Income Taxes

March 24, 2025NewsWith higher and retroactive Social Security benefits being paid this year to WEP and GPO retirees, members have called the ...Read More

What’s Next for Social Security Beneficiaries?

March 24, 2025NewsImplementing the Changes With WEP & GPO Repeal The recent repeal of the Windfall Elimination Provision (WEP) and Government Pension ...Read More

What Led To Victory In 2024?

February 21, 2025NewsThe Stars Finally Aligned Beyond expressing an extreme sense of relief and gratitude that the Social Security WEP and GPO ...Read More

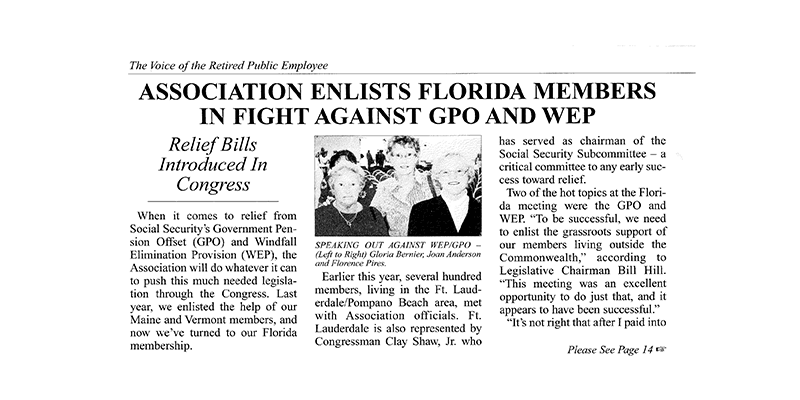

GPO’s Devastating Impact On Spouses & Survivors

February 17, 2025NewsSpurred on Mass Retirees Repeal Efforts From the very beginning, Mass Retirees was particularly concerned over the GPO’s devastating ...Read More

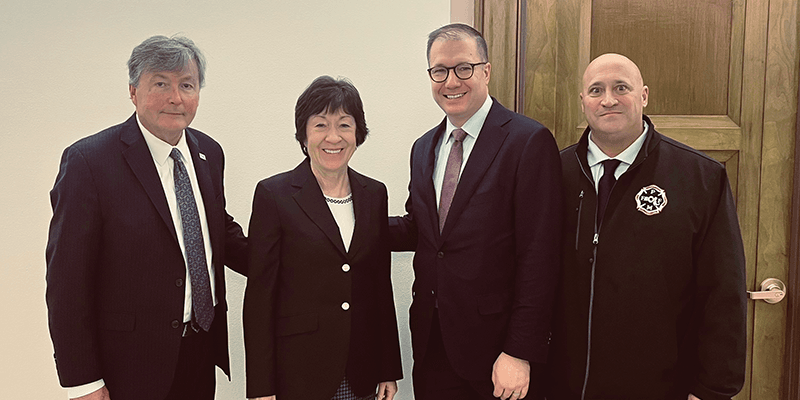

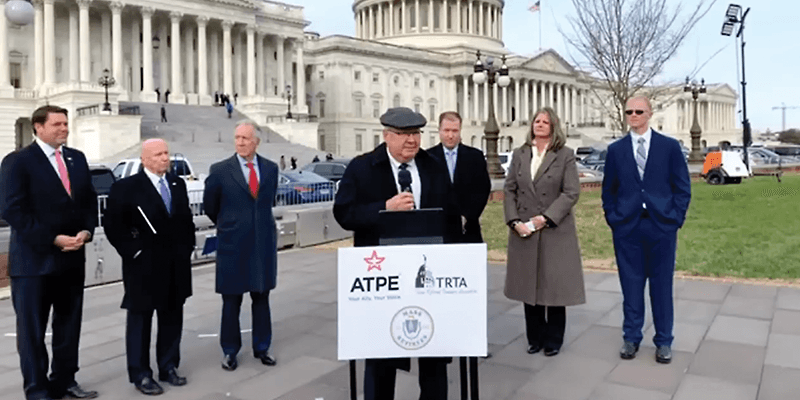

Bipartisan Effort To Resurrect a “Lost Cause”

February 16, 2025NewsGiven the elation surrounding the passage of the Social Security Fairness Act, it is easy to overlook the years, in ...Read More

Advisor Tom Lussier Played Key Role

February 14, 2025NewsThere are many unsung heroes here in Massachusetts and from across the country, who helped make WEP/GPO repeal a ...Read More

WEP & GPO REPEALED!!!

January 12, 2025Breaking News, News41-Year Fight for Social Security Fairness is Won On Sunday, January 5, 2025, at 4:42 PM EST, President ...Read More

Thank you! Now what’s next?

January 10, 2025Weekly News UpdateJanuary 10, 2025: If you read our special email blast last Sunday evening, have been following social media reports, or ...Read More

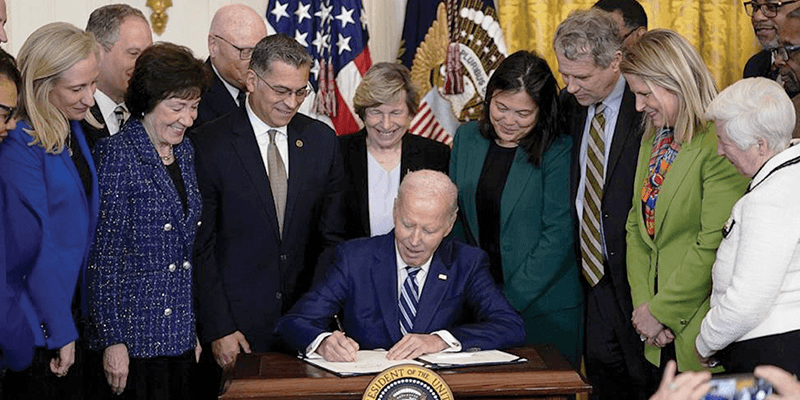

Biden Approves WEP/GPO Repeal

January 6, 2025Breaking News, NewsThe Social Security Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) laws are repealed! I just left the White ...Read More

Latest on WEP/GPO Repeal

December 24, 2024News, Breaking NewsWe are closed for the Holidays The Mass Retirees office is closed between Christmas and New Years. We will reopen ...Read More