Articles about Your Retirement that may be useful to Massachusetts retirees.

Outlook For The Next Six Weeks

November 7, 2025Weekly News UpdateThis week, we have a short update regarding our focus over the next six weeks leading up to the holiday ...Read More - Outlook For The Next Six Weeks

Locals Continuing to Increase Their COLA Base: Nineteen Systems Increase Fy26 Base

September 9, 2025NewsOver the past 5 fiscal years (FY22- FY26) Mass Retirees is pleased to report that local retirement systems have continued ...Read More - Locals Continuing to Increase Their COLA Base: Nineteen Systems Increase Fy26 Base

Investment Returns & Funded Ratios for 104 Retirement Systems

September 9, 2025NewsKey Factors Impacting a COLA Base Increase Earlier in this Voice (page 1) we reported on the 2024 Investment Report ...Read More - Investment Returns & Funded Ratios for 104 Retirement Systems

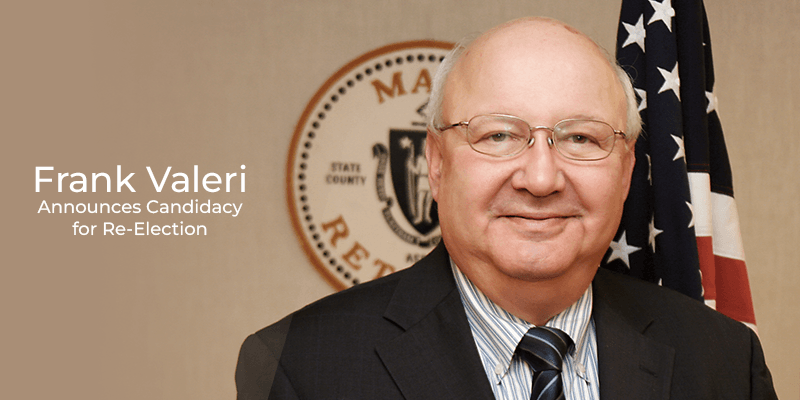

Valeri Announces Reelection for the State Retirement Board

September 8, 2025Breaking News, NewsMass Retirees President Frank Valeri has announced he will be a candidate for reelection to the State Retirement Board. Since ...Read More - Valeri Announces Reelection for the State Retirement Board

Neilon Appointed Executive Vice President: Retired as MTRS Asst. Exec. Director & CFO

September 3, 2025News, Breaking NewsWith the passing of Executive VP Paul Shanley, Association President Frank Valeri fully recognized the importance of filling his position ...Read More - Neilon Appointed Executive Vice President: Retired as MTRS Asst. Exec. Director & CFO

Healthcare Affordability Concerns Deepen

June 19, 2025Breaking News, NewsSteps Must Be Taken to Prevent Crisis Scenario For the better part of two years, Mass Retirees has sounded the ...Read More - Healthcare Affordability Concerns Deepen

2025-26 Membership Dues Increase

June 19, 2025NewsAs an Association representing public retirees who are living on fixed incomes, we are extremely mindful of the need to ...Read More - 2025-26 Membership Dues Increase