Confirmed in Study of Medicare’s Top 25 Part D Drugs

Leqembi and its potential impact on Medicare Part B is another stark example of prescription drugs, particularly specialty drugs, driving up healthcare costs. But, it doesn’t stand alone in that regard as shown in a recent Spotlight report by AARP (American Association of Retired Persons) that conducted an in-depth analysis of the prices for the top Medicare Part D drugs.

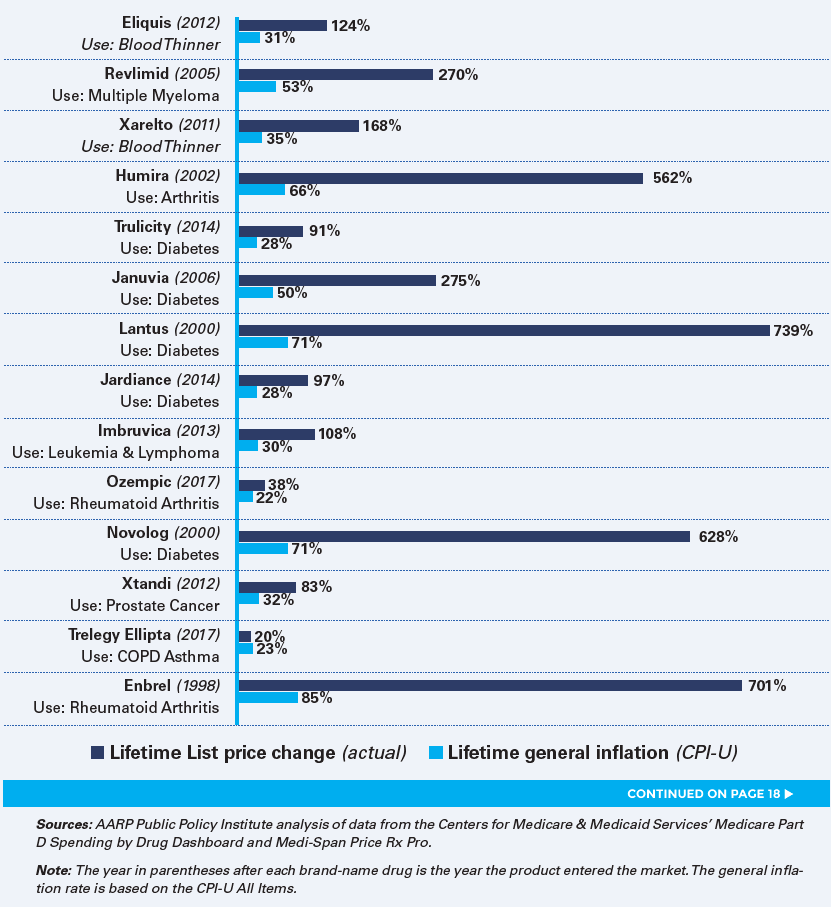

The Spotlight, prepared by AARP’s Public Policy Institute, analyzed the list prices for Medicare Part D’s top 25 drugs. These drugs were responsible for $80.9 billion in total Medicare Part D spending in 2021 and were used by a total of more than 10 million Part D enrollees.

What the Institute found is somewhat alarming:

- List prices for these drugs have increased by an average of 226%—or more than tripled during their lifetime since first entering the market.

- As shown in the Graph, these “lifetime” price increases, ranging from 20% to a whopping 739%, greatly exceeded the corresponding rate of general inflation over the period that each product. Only one (Trelegy Ellipta) did not exceed its corresponding inflation rate.*

- As the Graph also shows, lifetime list price changes increase dramatically the longer a product has been on the market. While the drugs have been on the market for an average of 14 years, the lifetimes range from 5 years to 23 years.

- While the Institute’s current analysis reflects a relatively small subset of brand-name prescription drugs, research indicates that the pricing trends found in this analysis are widespread.

“These findings are sobering,” observes President Frank Valeri. “And, they explain why the IRA (Inflation Reduction Act) didn’t stop with allowing Medicare to begin negotiating drug prices. No, it went further.

MEDICARE’S RX DRUG INFLATION PROGRAM UNDERWAY

Valeri continues, “I’m referring to another of the federal Inflation Reduction Act’s (IRA) key features, namely inflation-based rebates, that were highlighted in our November Voice and began last October. As we reported back then, these rebates require drug companies to pay back Medicare when they increase their prices faster than inflation.”

According to the AARP Institutes’ Spotlight, the Congressional Budget Of!ice has estimated that these inflation-based rebates will reduce enrollee and Medicare Part D program spending by billions of dollars and will lead to lower drug prices in the commercial insurance market.

According to recent reports from CMS (Centers for Medicare and Medicaid Services), the Medicare Prescription Drug Inflation Rebate Program is well underway and beginning to produce positive results. So far, twenty-seven prescription drugs are subject to Medicare’s inflation rebates. And, we expect that these rebates will offset future costs to be paid by Medicare and retirees.

“This is good news,” comments Valeri. “It’s hoped that these inflation- based rebates will discourage drug companies in the future from engaging in the type of lifetime pricing increases that AARP has so clearly placed under the spotlight.”

Medicare’s Top 25 Rx Drugs: Price Increases vs. General Inflation